UPDATE x 2: While Billy Corgan’s lawsuit is still sealed, his response to TNA’s claims was filed with the Chancery Court this morning.

Corgan stated that “Defendants first attempt to portray Corgan’s complain and application for injunctive relief as nothing more than a back-handed grab for power.” He says that he has great passion for TNA Wrestling’s talents and fans and that the “last thing” he wanted to do was file suit, but he had done everything he could to avoid litigation and was forced into it due to the defendants’ “repeated willful disregard of their contractual obligations to him.” he then claims that documents produced on their own “demonstrates that defendants have been engaging in an orchestrated effort” to deprive Corgan of those contractual rights.

The TNA side is arguing that any injunction should be denied because they “have secured financing to pay Corgan the full amount to which he is entitled.” Corgan responded that is false and “defendants have merely obtained a proposal for financing a portion of the amount Corgan is due, and that financing proposal is premised upon conditions that cannot be fulfilled, named obtaining a release from Corgan that is not obligated to provide and will not provide for various reasons.” TNA wanted him to release them from all claims in order for Corgan to get his money, which he refused.

In regards to TNA being insolvent, Corgan claimed that the defendants have attempted to provide “circumstantially” that Impact Ventures is solvent based on “a jaundiced view of certain investment and asset purchase proposals. Even so, Impact Ventures’ true debts are higher than any value of its assets even suggested by that circumstantial evidence. Thus, it is clear that Impact Ventures is insolvent and that Corgan is entitled to exercise Mrs. Salinas’ voting rights in the company.”

The response also say that the defendants have labeled him as a “predatory lender” with “strong arm loans.” Corgan responded that he took the risk of investing “significant sums” into Impact to save it from being “shuttered” and negotiated “at arms-length” terms that all parties agreed to. His goal now is to stop the defendants from reneging on their promises to him. Corgan noted that “adding insult to injury, the documents the Court ordered defendants to produce demonstrate that defendants misled Corgan every step of the way.”

In order to prove TNA insolvent, Corgan noted the following issues, which have gotten progressively worse since August…

* The American Express, Audience of One and Bankcredit Capital Finance lawsuits.

* The company being in such “dire straits that it was unable to pay officers’ salaries” as of August 31st; specifically noting that Dixie Carter and Serg Salinas are owed in back pay.

* As of September 1st, “checks issued to talent bounced”, with Dean Broadhead stating in one document, “We owe talent money. We owe employees money. we (sic) many vendors money.”

* As September 8th, Impact Ventures was unable to pay its state taxes, leading to the tax lien.

* As September 8th, the company’s operating account was overdrawn by [redacted] yet the company had trade accounts payable totaling at least [redacted.]

* As October 3rd, Impact Ventures was unable to pay vendor “Seismic Sound” a redacted amount, leading them to threaten collection actions.

* November TV tapings were postponed due to lack of funding.

* The defendants not paying talent and blaming Corgan and the temporary restraining order for not paying them.

* The company owes money to a “SRX Consultancy.”

Corgan went on to say, “Although expressly stated, defendants also appear to argue that they can continue to dig the company deeper and deeper into a financial hole by obtaining additional debt to fund their operations.” Added that even after they secured a loan from MCC Acquisitions in September, it was not able to finance it’s production of tapings in October as well as avoid the plethora of collection lawsuits and the tax lien. Corgan added, “Simply put, it defies logic to assert that Impact Ventures can somehow make itself solvent by becoming more and more insolvent.”

Corgan argues that the defendants have not provided the Court with “any direct evidence of the value” of their assets. “Instead, defendants only offer weak circumstantial evidence in the form or investment and asset purchase proposals from Corgan and WWE.” Corgan adds that the evidence “does not even come remotely close” to proving the company is solvent.

Corgan again states that he was never told the true nature of the company’s debts and that it is unclear if the company ever “advised” WWE what the levels of Impact Ventures’ debts were in September 2016. The filing goes onto say “If defendants falsely represented to WWE that the company’s liabilities were only [redacted] as stated in the June 30, 2016 balance sheet, the evidentiary value of any “offer” WWE may have made would be even more dubious.”

Corgan is arguing that he has the right to either demand payment or convert his debt into a 36% ownership of the company.

UPDATE: New documents were filed today prior to the scheduled hearing in the Billy Corgan vs. TNA lawsuit and if you can believe it, things have gotten worse.

In a redacted memo filed with the court, Corgan laid out his argument for why TNA is insolvent and notes that currently Impact Ventures’, “balance sheet shows the company’s debts are close to ten times the company’s assets.” He goes on to state that the company falls under the definition of insolvent for the state of Tennessee, which describes the term as similar to the definition of the term in the Uniform Commercial Code and the Bankruptcy Act. Under that act, ‘insolvent means having generally ceased to pay debts in the ordinary course of business other than as a result of a bona fide dispute, being unable to pay debts as they become due or being insolvent within the meaning of federal bankruptcy law.”

Corgan’s side also claims that according to Rule 65 of Tennessee Rules of Civil Procedure, the court is authorized to issue temporary restraining orders “without notice to the adverse party” if “specific facts in an affidavit or a verified complain clearly show that immediate and irreparable injury, loss, or damage will result to the applicant before the adverse party can be heard in opposition.” His side also argues that because this is a private issue between Corgan and the defendants, it is possible that they will cause Corgan “immediate and irreparable harm” if left unchecked.

Corgan also filed a redacted declaration, which explained why he invested in the company. Corgan claims that the defendants hid how bad the company’s debts were in order to get the investment from him. He describes the initial loan (June 10th) and says that he was given a “senior secured” promissory note. At the time he was not aware that Aroluxe and Anthem Media Sports and Entertainment had already been granted seniority regarding the debt they were owed. Basically, he invested under the belief he would be first in line to be repaid, only to learn he was actually third in line.

Corgan goes onto claim that Dixie Carter and TNA Chief Financial Officer Dean Broadhead told him that TNA had a debt of a certain amount, and was never told the company actually had debts of “over [redacted.]” Corgan alleges that he was misled about the amount of money the company actually owed before he made his first investment. He also says that he was never informed of the actual debt when he made his second investment in July and only learned of the actual level of debt in September 2016 when he was provided a company balance sheet (dated June 30th of 2016) by TNA Chief Financial Officer Dean Broadhead. Corgan only learned of the company’s actual debt, “in the course of this litigations through the documents that Impact Ventures produced.” Corgan wrote, “I did not know that Impact Venture’s debts were that high. I never would have agreed to invest additional capital in Impact Ventures had I known the company’s debts were that high.”

Corgan claims the defendants misled him into his third loan back in August, stating that he was misled based on “repeated representation” by Dixie Carter that “acquisition negotiations” were underway with third parties and that an acquisition of the company was “imminent.” This included a proposed investment from Aroluxe. He also says that he learned that the company failed to pay its taxes from reading an article in the Tennessean newspaper and that a lien has been filed against the company. He also found out that a number of lawsuits had been filed against the company by Audience of One Productions, American Express, and by Bankdirect Capital Finance, LLC in a similar way.

Corgan then states that TNA is STILL not paying talent, and that they are blaming him for this…

“Impact Ventures also continues to not pay its talent, except now defendants are blaming me and the temporary restraining order in this case for lack of payment.”

His attorney was sent a declaration certificate, that would have required Corgan to give the company a “full release of all claims” against them. Corgan did not sign, stating the following…

“I will not agree to provide Impact Ventures with a ‘full release’ as a condition to the repayment of my loan proceeds. I am not required under any of the loan documents to provide such a release in return for full payment. I also believe that I have claims against Impact Ventures and the other defendants that are separate and apart from the claims that I have currently asserted herein, and I am not willing to waive or release those claims.”

Corgan goes onto state that he was never given a proposed draft of an employment agreement for his role as President of the company. He also says that has not been provided “with access to the information I would require under the Second Amended Corgan Loan Agreement” that would allow him to make an “informed decision” as to whether to convert his loan into an “equity position” in the company.

Corgan says that Jason Brown (Aroluxe) “has undertaken the duties of managing the day-to-day operations of the company”, while Corgan has been excluded from those duties despite his title. Brown has reportedly been “planning events for 2017 and negotiating contracts with talent.”

ORIGINAL: TNA and Billy Corgan will be in court today at 1PM ET in the Chancery Court of Davidson County in Nashville, TN. Today could see not only the short-term, but also the long-term future of the company decided.

Both sides will appear before Chancellor Ellen Hobbes Lyle regarding the lawsuit filed by Corgan against Impact Wrestling, its parent company Impact Ventures, its Chairwoman and former President Dixie Carter, Chief Financial Officer Dean Broadhead and Serg Salinas. Corgan had previously received a temporary injunction, which would prevent any of the defendants from doing any business for the company without Corgan’s approval. It would also prevent anyone from trying to sell the company or its assets.

It is possible, based on what has been submitted to the court, that Chancellor Ellen Hobbes Lyle could rule today that Corgan does indeed have Carter’s voting rights and ownership of the company.

A settlement is unlikely at this time, and that even if Corgan’s claims are shot down, the damage has been done to TNA. The company’s financial status is out in the open, there are numerous lawsuits out there against the company, and creditors are concerned about collecting. Last week, Anthem Media claimed that they were willing to pay Corgan back his money to go away and that they were willing to step in and finance the company. But after the reveal of all the lawsuits, and very public status of TNA’s financial situation, that may not be the case.

More details on the lawsuit are available here. Corgan is seeking full control of the company.

100% DIRECT LINK (PHOTOS): Brooke Tessmacher With Her Family!!! **TWIN SISTER**!!

NJPW Windy City Riot 2024 Results – April 12, 2024 – Tetsuya Naito vs. Jon Moxley

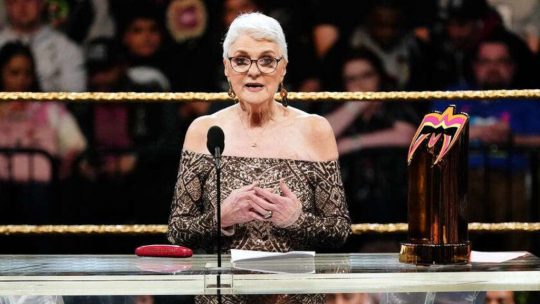

NJPW Windy City Riot 2024 Results – April 12, 2024 – Tetsuya Naito vs. Jon Moxley WWE: Longtime WWE Employee Sue Aicthison Reportedly No Longer with WWE, Update on Tama Tonga’s Signing, Sheamus Return Set for April 15th RAW Show

WWE: Longtime WWE Employee Sue Aicthison Reportedly No Longer with WWE, Update on Tama Tonga’s Signing, Sheamus Return Set for April 15th RAW Show Backstage Update on Drew McIntyre’s WWE Contract & Talks for Potential New Deal

Backstage Update on Drew McIntyre’s WWE Contract & Talks for Potential New Deal