As noted before, WWE announced this past April that they have entered an agreement to sell their company to Endeavor, who is the parent company of UFC. As part of the terms of the deal, WWE and UFC will be merging into a new currently unnamed company.

In a recent filing to the SEC, WWE stated that their upcoming merger with UFC into a new company currently has the placeholder name of New Wale Inc. It was also stated that this will not become the official name of the new merged company and instead it will be changed prior to the completion of their sale to Endeavor.

In regards to the Board of Directors for this new merged company, it was stated that it will be an eleven-member board with five chosen from WWE and six chosen by Endeavor. WWE Executive Chairman Vince McMahon and Endeavor CEO Ari Emanuel were stated to be two of the members of this new Board.

In regards to WWE’s talks with potential interested buyers before their deal with Endeavor, it was stated that the company had been in talks with 60 different interested parties. It was also stated that the company had signed confidentially agreements with 20 of these interested parties regarding the nature of their talks.

Beginning on January 17, 2023 and continuing until April 2, 2023, when WWE executed the transaction agreement, WWE’s financial advisors, acting on its behalf, contacted and were contacted by over 60 potential counterparties, including strategic companies, financial sponsors, family offices and sovereign wealth funds. Between February 6 and March 21, 2023, WWE entered into confidentiality agreements with 20 potential counterparties. All but one of the confidentiality agreements entered into by WWE in connection with this process included a standstill provision for the benefit of WWE with a customary exclusion permitting parties to make proposals to WWE privately and confidentially, and each of the standstill provisions had a duration of at least 12 months. All confidentiality agreements entered into with standstill provisions included the customary exclusion for private proposals and a “fallaway” provision that would allow the counterparty to make a proposal to acquire WWE in the event WWE entered into a definitive sale agreement. Each potential counterparty that had indicated interest in exploring a strategic transaction with WWE was provided an opportunity to enter into a confidentiality agreement with WWE.

In regards to stock transfers, it was stated that one share of WWE common stock will be worth one Class A common stock share of the new merged company’s stock.

WWE stockholders will receive one share of New PubCo Class A common stock for each share of WWE common stock that they hold. As of the Closing, subsidiaries of Endeavor are expected to collectively own 51% of the voting power of New PubCo and 51% of the economic interests in HoldCo, with former security holders of WWE common stock indirectly owning 49% of the economic interests in HoldCo, 49% of the voting power of New PubCo and 100% of the economic ownership of New PubCo, in each case, on a fully diluted basis. The value of the transaction consideration the WWE stockholders will receive in the Transactions, including the merger, will therefore depend on the combined value of HoldCo and WWE at the effective time.

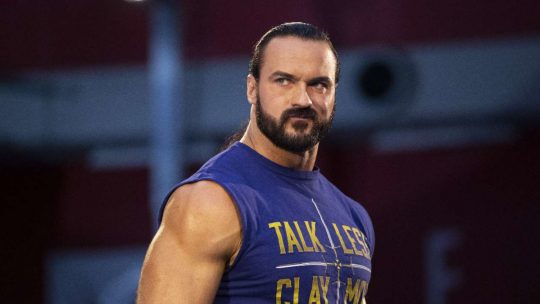

This filing also stated the estimated monetary amount that certain WWE executives would receive following the completion of their sale transaction. It was stated that Vince McMahon will receive $16,027,770, WWE CEO Nick Khan will receive $72,023,451, WWE CCO Paul “Triple H” Levesque will receive $25,625,995, WWE CFO Frank Riddick will receive $20,117,224 , WWE Executive Producer & Head of Global Television Distribution Kevin Dunn will receive $31,880,058, and WWE Chief Human Resources Officer Suzette Ramirez-Carr will receive around $3,356,150.

This filing also listed former WWE co-CEO Stephanie McMahon as an executive of the company but it was stated that she will not receive any compensation from WWE’s sale transaction and the reasons why this will not happen.

Ms. McMahon formerly served as WWE’s Co-Chief Executive Officer through January 10, 2023 and is not a current employee of WWE. She does not hold any outstanding WWE equity awards and is no longer party to arrangements pursuant to which she could receive cash or severance payments and benefits in connection with the Transactions, including the merger.

The filing also included the monetary terms should one of WWE’s executives be legally terminated from their job.

Under the applicable agreement with WWE, in the event of a qualifying termination, the named executive officers, other than Ms. McMahon and Mr. Dunn, are entitled to receive a lump-sum cash payment in the amount of (i) 2x base salary for Messrs. McMahon and Khan, (ii) 1.5x base salary for Messrs. Riddick and Levesque and (iii) 1x base salary for Ms. Ramirez-Carr. Under WWE’s severance policy, Mr. Dunn is entitled to receive 12 months of base salary continuation. As of the date of this information statement/prospectus, Ms. McMahon is not party to any contractual arrangement with WWE pursuant to which she could receive cash or severance payments and benefits in connection with a qualifying termination.

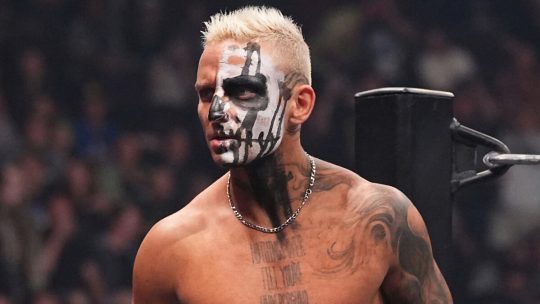

WWE NXT Spring Breakin 2024 Week 1 Notes: Results, Tyson Dupont & Tyriek Igwe NXT Debut Set for 4/30 Show, Shayna Baszler Surprise Return, Spring Breakin 2024 Week 2 Card, Trick Williams Wins NXT Title

WWE NXT Spring Breakin 2024 Week 1 Notes: Results, Tyson Dupont & Tyriek Igwe NXT Debut Set for 4/30 Show, Shayna Baszler Surprise Return, Spring Breakin 2024 Week 2 Card, Trick Williams Wins NXT Title WWE: Update on Vince McMahon Selling Remainder of His TKO Group Stock & Nick Khan Also Selling His Stock, More on NXT April 23, 2024 Viewership, More News

WWE: Update on Vince McMahon Selling Remainder of His TKO Group Stock & Nick Khan Also Selling His Stock, More on NXT April 23, 2024 Viewership, More News ROH TV Taping Spoilers for Future Episode

ROH TV Taping Spoilers for Future Episode