TKO Group held an investor’s meeting on Wednesday to discuss the results from their fiscal 2025 second quarter report.

In regards to revenues, TKO generated $1.308 billion in net revenues for the fiscal quarter with the split being $415.9 million from UFC and $556.2 million from WWE. It was stated that IMG generated the remainder of $306.6 million for net revenues. This was up 10% overall and up from the $456.8 million from WWE and $394.4 million from UFC compared to the same fiscal quarter last year.

TKO generated a net income of $273.1 million for the fiscal quarter, up from the $150.7 million compared to the same fiscal quarter last year.

In regards to other financial areas, TKO’s Adjusted EBITDA for the fiscal quarter was $526.5 million. WWE’s media rights and content revenue for the fiscal quarter was $278.9 million. WWE’s live events revenue was $185.7 million, sponsorship revenue was $58.3 million, and consumer products revenue was $33.3 million for the fiscal quarter.

TKO Reports Second Quarter 2025 Results

Raises Full Year 2025 Guidance

ESPN and WWE Today Announced a Multiyear Domestic Rights Agreement for WWE Premium Live Events

Acquired Businesses

On February 28, 2025, TKO Group Holdings, Inc. (“TKO”) completed the acquisition of certain businesses operating under the IMG brand (“IMG”), On Location, and Professional Bull Riders (“PBR”) (collectively referred to as the “Acquired Businesses”). As a common control acquisition, reported results presented in this earnings release reflect the Acquired Businesses as if they had been part of TKO during the historical periods presented. (See “Basis of Presentation” for further details.)

Second Quarter 2025 Financial Highlights1

* Revenue of $1.308 billion

* Net income of $273.1 million

* Adjusted EBITDA2 of $526.5 millionFull Year 2025 Guidance3

The Company increased its targets for revenue to $4.630 billion to $4.690 billion

The Company increased its targets for Adjusted EBITDA to $1.540 billion to $1.560 billion

NEW YORK–(BUSINESS WIRE)– TKO Group Holdings, Inc. (“TKO” or the “Company”) (NYSE: TKO) today announced financial results for its second quarter ended June 30, 2025.

“TKO generated strong financial results in the quarter, led by record performance at both UFC and WWE,” said Ariel Emanuel, Executive Chair and CEO of TKO. “Our live content and experiences are proving a key differentiator for organizations and brands looking to capture audience, and our strategy is tailor made for today’s experience economy and the white-hot sports event marketplace. Given the continued momentum across our portfolio and our overall business outlook, we are raising our guidance for the full year.”

ESPN and WWE Agreement

Earlier today, ESPN and WWE announced a five-year agreement to bring WWE’s premium live events (“PLEs”) in the U.S. to ESPN’s new direct-to-consumer offering. The ESPN DTC service will stream all WWE PLEs annually, in their entirety, with select simulcasting on ESPN linear platforms.

“For much of the past 45 years, ESPN has been the institution of record in the world of sports,” said Mark Shapiro, President and COO, TKO. “We are proud WWE will now take a prominent seat at its table during such a transformational juncture. As we look to the second half of 2025, we remain focused on delivering the next UFC domestic media rights deal, integrating industry leaders IMG, On Location, and PBR fully into TKO, and executing on our capital return initiatives.”

Consolidated Results

Second Quarter 2025

Revenue increased 10%, or $115.2 million, to $1.308 billion. The increase primarily reflected an increase of $21.5 million at UFC, to $415.9 million, and an increase of $99.4 million at WWE, to $556.2 million, partially offset by a decrease of $13.0 million at IMG, to $306.6 million.

Net Income was $273.1 million, an increase of $226.9 million from $46.2 million in the prior year period. The increase primarily reflected the increase in revenue and a decrease in operating expenses. The decrease in operating expenses reflected a decrease in direct operating costs of $114.8 million, a decrease in selling, general and administrative expenses of $3.9 million, and a decrease in depreciation and amortization of $19.5 million. The decrease in direct operating costs was primarily due to the write down of unsold tickets that was recorded in the prior year period in the IMG segment for the 2024 Paris Olympics.

Adjusted EBITDA2 increased 75%, or $225.7 million, to $526.5 million, primarily due to an increase of $12.9 million at UFC, to $244.8 million, an increase of $78.5 million at WWE, to $329.8 million, an increase of $120.2 million at IMG, to $29.0 million, and an increase of $14.1 million at Corporate and Other, to ($77.1) million.

Adjusted EBITDA margin increased to 40% from 25%.

Cash flows generated by operating activities were $396.2 million, an increase of $89.1 million from $307.1 million, primarily due to higher net income partially offset by the timing of working capital. Working capital included the favorable impact of approximately $164.8 million of pre-payments held in escrow related to the 2026 FIFA World Cup as well as the adverse impact of a $125.0 million payment related to the UFC antitrust lawsuit. (See “Other Matters” for further details.)

Free Cash Flow4 was $374.9 million, an increase of $94.6 million from $280.3 million, due to the increase in cash flows generated by operating activities and a decrease in capital expenditures.

Cash and cash equivalents were $535.1 million as of June 30, 2025.

Gross debt was $2.769 billion as of June 30, 2025.

UFC

Second Quarter 2025

Revenue increased 5%, or $21.5 million, to $415.9 million primarily driven by a $24.1 million increase in partnerships and marketing revenue, and a $9.9 million increase in media rights, production and content revenue, partially offset by a $10.6 million decrease in live events and hospitality revenue. The increase in partnerships and marketing revenue was primarily related to new partners and an increase in fees from renewals compared to the prior year period. The increase in media rights, production and content revenue was primarily related to the contractual escalation of media rights fees compared to the prior year period. The decrease in live events and hospitality revenue was primarily due to a decrease in site fee revenues, related to the timing and mix of international events, compared to the prior year period.

Adjusted EBITDA increased 6%, or $12.9 million, to $244.8 million, as the increase in revenue (as described above) was partially offset by an increase in expenses. Direct expenses decreased due to lower production, marketing, athlete and other event-related costs primarily due to the mix of event cards, venues and territories, compared to the prior year period. Selling, general and administrative expenses increased primarily due to higher personnel and travel costs compared to the prior year period.

Adjusted EBITDA margin was 59% for both periods.

WWE

Second Quarter 2025

Revenue increased 22%, or $99.4 million, to $556.2 million primarily related to a $41.6 million increase in live events and hospitality revenue, a $33.6 million increase in partnerships and marketing revenue, an $18.2 million increase in media rights, production and content revenue, and a $6.0 million increase in consumer products licensing and other revenue. The increase in live events and hospitality revenue was due to higher ticket sales revenue as well as an increase in site fees, primarily due to revenue recorded related to both domestic and international premium live events. The increase in partnerships and marketing revenue was primarily due to new partners and an increase in fees from renewals compared to the prior year period, most notably related to WrestleMania 41. The increase in media rights, production and content revenue was primarily related to the timing of the previously disclosed format expansion of SmackDown as well as the contractual escalation of media rights fees, notably the impact of WWE’s global content distribution agreement with Netflix, compared to the prior year period. The increase in consumer products licensing and other revenue was primarily related to higher video gaming revenue and merchandise sales compared to the prior year period.

Adjusted EBITDA increased 31%, or $78.5 million, to $329.8 million, primarily due to the increase in revenue (as described above) partially offset by an increase in expenses. Direct expenses increased primarily due to higher production and talent-related costs compared to the prior year period. Selling, general and administrative expenses increased primarily due to higher personnel and travel costs compared to the prior year period.

Adjusted EBITDA margin increased to 59% from 55%.

Other notable highlights from TKO’s investor’s meeting:

- A prepared statement was read from TKO CEO Ari Emmanuel who praised the new ESPN deal for WWE and WWE’s Money in the Bank 2025 event being the highest grossing arena event of all time for the company. Emmanuel also brought up how WWE has set 36 records and had 16 sellouts as well as the 113,000+ attendance for SummerSlam 2025 in New Jersey.

- On the topic of WWE’s new deal with ESPN, TKO COO Mark Shapiro stated that they may have been able to get a greater rights fees with another platform but they wanted to tap into the ESPN audience. Shapiro also stated that they could simulcast the first hour or so of a WWE show on ESPN’s linear channel and then shift to the streaming side for the rest of a show. TKO CFO Andrew Schleimer stated that WWE’s five documentaries, NXT PLEs, and WWE’s archives are not included in the new ESPN deal. Schleimer stated that they have the chance to take that elsewhere and monetize that as well.

- In regards to the current talks for UFC’s new media rights deal, they stated that they are in the “home stretch” on UFC rights and will announce when they have something to announce.

- Shapiro stated that TKO’s goal is to increase profitability and create bigger margins. Shapiro also stated that they want to do film and documentaries with the WWE crew and go out and sell them. Shapiro also stated that they are going to maximize their archives and notn every deal is equal.

- On the topic of SummerSlam turning into a two-night event, Shapiro stated that SummerSlam is becoming “another” WrestleMania for them and the site fees will help get them where they want to be financially.

- On the topic of WWE’s sponsorship deals, Shapiro stated that WWE was a blank canvas when it came to sponsorships “walking in” and them going out and selling integrations in regards to the mat, the arena, etc. was all fertile ground. Shapiro also stated that they are optimistic as what else they can do with WWE on this aspect.

- Shapiro also stated that their first WWE PLE on ESPN has to have the feel of a Super Bowl and they expect to have that type of treatment on ESPN.

- In regards to TKO Boxing, they stated that they view TKO Boxing as a major tent pole asset for the company going forward. They stated that they are receiving a $10 million fee for overseeing operations and they have no financial investment. They also stated that they are looking to do 2-3 super fights a year and get a fee to promote it and also get a fee for media rights they negotiate for it.

Source: PWInsider.com

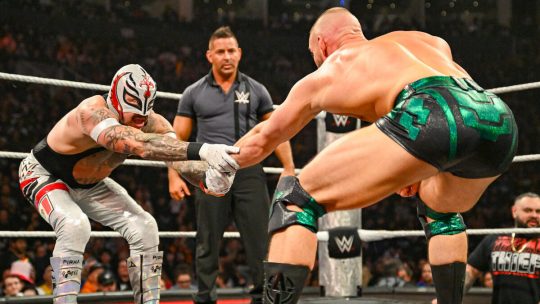

WWE: Backstage Update on Rey Mysterio’s Injury at 1/26 WWE RAW Show, Release Date for WWE 2K26 Reportedly Revealed, Becky Lynch on “Timeless” Toni Storm Being Her Non-WWE Dream Match Opponent

WWE: Backstage Update on Rey Mysterio’s Injury at 1/26 WWE RAW Show, Release Date for WWE 2K26 Reportedly Revealed, Becky Lynch on “Timeless” Toni Storm Being Her Non-WWE Dream Match Opponent TNA Impact! Notes: Ash By Elegance Gets Physical, Trey Miguel Returns & Signed New Contract, Miguel, Eric Young, Steve Maclin, & Eddie Edwards Wins Feast or Fired Briefcases, Bear Bronson & Cedric Alexander Revealed as Newest Members of The System, The System Turns on JDC & Moose, 1/29 Show Card

TNA Impact! Notes: Ash By Elegance Gets Physical, Trey Miguel Returns & Signed New Contract, Miguel, Eric Young, Steve Maclin, & Eddie Edwards Wins Feast or Fired Briefcases, Bear Bronson & Cedric Alexander Revealed as Newest Members of The System, The System Turns on JDC & Moose, 1/29 Show Card Seth Rollins Says He Will Not Be At WWE Royal Rumble 2026

Seth Rollins Says He Will Not Be At WWE Royal Rumble 2026