According to business analysts, the UFC’s $4 billion sale puts WWE at a comparative value of just a little bit less. The Wrap reports that Wells Fargo, said WWE has an approximate value of $3.4 with the UFC’s sale in mind.

Wells Fargo currently believes WWE could have an equity valuation of $36-$44 per share, which is around 80% to 120% of the actual $20.46 stock price as of Monday’s close. That price was up 5% from the opening price.

“Although we view this as an interesting exercise in determining the potential value of WWE — in our opinion, Chairman Vince McMahon is NOT selling the company anytime soon,” Wells Fargo said. “But with positive Network sub trends, a clean balance sheet, new TV rights deals just 2-3 years out, and now a clear sign of demand for somewhat similar content, we are raising our valuation range to $23-25 from $20-22.”

The analysts continued, “It’s important to point out that there were several bidders for the UFC, with reports that this included the Dalian Wanda Group and China Media Capital. The point here is that content in the realm of sports has substantial value due to its live viewership — and WWE’s weekly shows are predominantly viewed live.”

100% DIRECT LINK (PHOTOS): Brand New **VERY LEGGY** Eve Torres Gallery! **HOLY SH*T**!!!

WWE RAW Notes: Jimmy Uso Returns, Brie Bella Reveals Reason for WWE Return & Bella Twins Reunion, Dominik Mysterio Surprise Return, Stephanie Vaquer Debuts New Entrance Theme Song, Roman Reigns Picks CM Punk & WWE World Title For WrestleMana 42 Match, 2/9 Show Card

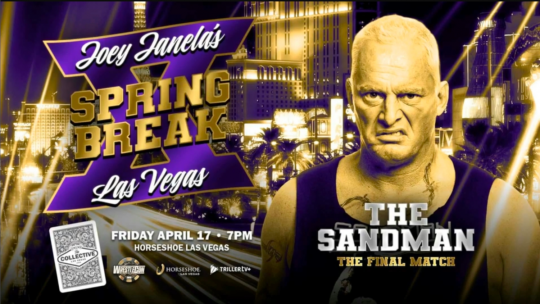

WWE RAW Notes: Jimmy Uso Returns, Brie Bella Reveals Reason for WWE Return & Bella Twins Reunion, Dominik Mysterio Surprise Return, Stephanie Vaquer Debuts New Entrance Theme Song, Roman Reigns Picks CM Punk & WWE World Title For WrestleMana 42 Match, 2/9 Show Card The Sandman’s Final Match Set for GCW Joey Janela’s Spring Break X

The Sandman’s Final Match Set for GCW Joey Janela’s Spring Break X Scrapped Plans for Bron Breakker To Win 2026 WWE Men’s Royal Rumble Match

Scrapped Plans for Bron Breakker To Win 2026 WWE Men’s Royal Rumble Match