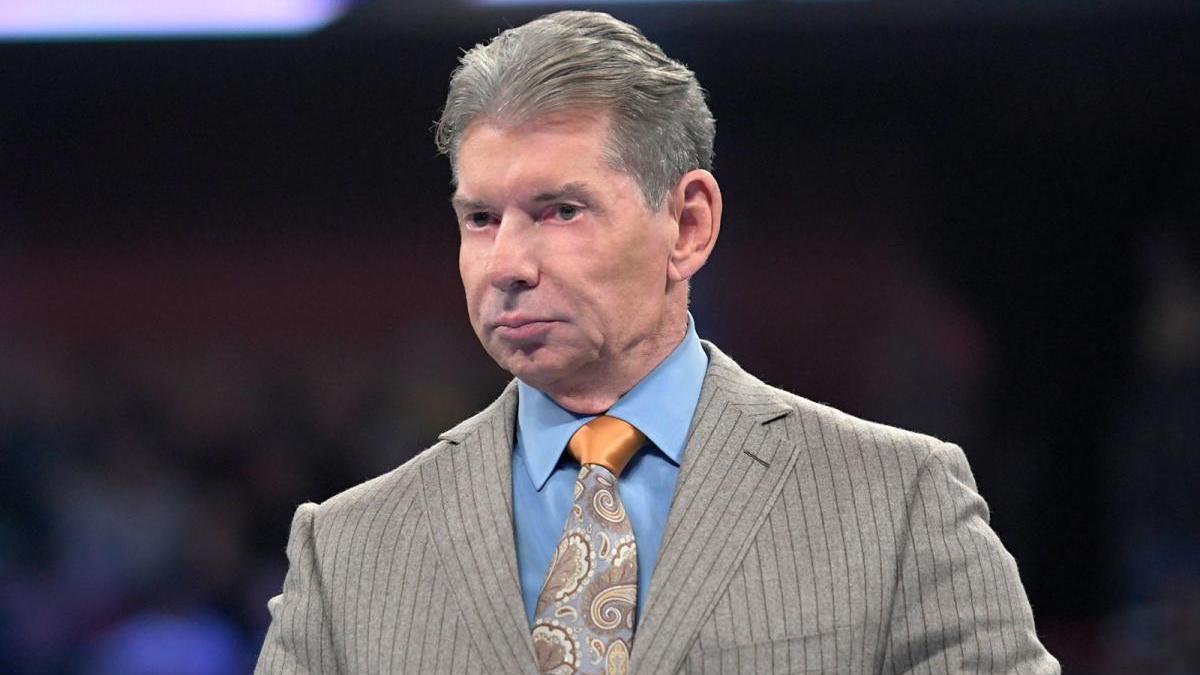

As noted before, former WWE CEO and Chairman Vince McMahon retired from the company this past July. WWE’s Board of Directors have been conducting an on-going investigation against McMahon over allegations of sexual misconduct and secret “hush money” payments towards several former female employees and at least one talent. Besides the “hush money” payments, WWE also recently discovered an additional $5 million in secret payments that were not related to the current allegations against him.

WWE recently filed their 10-Q report to the SEC ahead of today’s investor’s meeting. In the filing, the company stated that their on-going investigation against McMahon is “substantially complete” and is currently expected to cost the company around $10 million.

As previously announced, a Special Committee of independent members of the Company’s Board of Directors was formed to investigate alleged misconduct by the Company’s former Chairman and Chief Executive Officer, Vincent K. McMahon. The Special Committee investigation is substantially complete. Mr. McMahon resigned from all positions held with the Company on July 22, 2022 but remains a stockholder with a controlling interest. While we currently anticipate spending approximately $10 million during the remainder of the year related to this investigation, the related costs could exceed this estimate.

In the filing, WWE also stated that McMahon’s resignation from the company could negatively affect the company in regards to its financial outlook and creative output, mostly in regards to “our ability to create popular characters and creative storylines”

The Company’s recent Special Committee investigation could result in a material adverse effect on our financial performance.

On June 17, 2022, the Company and its Board of Directors announced that a special committee of independent members of our Board of Directors (the “Special Committee”) was formed to investigate alleged misconduct by the Company’s former Chairman and Chief Executive Officer, Vincent K. McMahon. The Special Committee investigation is substantially complete. Mr. McMahon resigned from all positions held with the Company on July 22, 2022 but remains a stockholder with a controlling interest. On July 25, 2022, based on the findings of the Special Committee investigation, the Company announced that it had determined that certain payments that Mr. McMahon agreed to make during the period from 2006 through 2022 (including amounts paid and payable in the future totaling $14.6 million) were not appropriately recorded as expenses in the Company’s Consolidated Financial Statements. The Company subsequently identified two additional payments totaling $5.0 million, unrelated to the alleged misconduct by Mr. McMahon that led to the Special Committee investigation, that Mr. McMahon made in 2007 and 2009 that were not appropriately recorded as expenses in the Company’s Consolidated Financial Statements. Together, these unrecorded expenses total $19.6 million (the “Unrecorded Expenses”). All payments underlying the Unrecorded Expenses were or will be paid by Mr. McMahon personally. The Company has determined that, while the amount of Unrecorded Expenses was not material in any individual period in which the Unrecorded Expenses arose, the aggregate amount of Unrecorded Expenses would be material if recorded entirely in the second quarter of 2022. Accordingly, the Company is revising its previously issued financial statements to record the Unrecorded Expenses in the applicable periods for the years ended December 31, 2019, 2020 and 2021, as well as the first quarter of 2021 and 2022. In light of the Unrecorded Expenses and related facts, the Company has concluded that its internal control over financial reporting was not effective as a result of one or more material weaknesses. The Company has also received, and may receive in the future, regulatory, investigative and enforcement inquiries, subpoenas or demands arising from, related to, or in connection with these matters. Professional costs resulting from the Special Committee’s investigation have been significant and are expected to continue to be significant as the investigation continues and/or if litigation costs relating to these regulatory, investigative and enforcement inquiries, subpoenas and demands grow. Although we believe that no significant business has been lost to date, it is possible that a change in the perceptions of our business partners could occur as a result of the investigation. In addition, as a result of the investigation, certain operational changes including without limitation personnel changes have occurred and may continue to occur in the future. Any or all of these impacts based on the findings of the investigation and related matters and the surrounding circumstances could exacerbate the other risks described herein and directly or indirectly have a material adverse effect on our operations and/or financial performance.

The resignation of Vincent K. McMahon could adversely affect our ability to create popular characters and creative storylines or could otherwise adversely affect our operating results.

Until he resigned from all positions held with the Company on July 22, 2022, in addition to serving as Chairman of our Board of Directors and Chief Executive Officer, Mr. McMahon led the creative team that develops the storylines and the characters for our programming (including our television, WWE Network and other programming) and live events. On July 22, 2022, the Board appointed Stephanie McMahon, at that time Chief Brand Officer, interim Chief Executive Officer, interim Chairwoman and a director of the Company, and Nick Khan, at that time President, Chief Revenue Officer and a director of the Company, to serve as the Company’s co-Chief Executive Officers. The Board has also appointed Stephanie McMahon to serve as the Company’s Chairwoman. Furthermore, in the wake of Mr. McMahon’s departure, our creative effort will be led by Paul Levesque, the Company’s Executive Vice President, Talent Relations and Creative and Ms. McMahon’s husband, who has decades of experience in our Company and has been an important player in all aspects of our creative process, including television, talent and live events. Although Mr. Levesque has extensive practical experience with many of our revenue streams and, with Ms. McMahon, has been critically involved in our business transformation over the past several years as well as our continuing brand development, these collective changes at the top of our organization are extensive and recent, and it is therefore possible that the loss of services of Mr. McMahon could have a material adverse effect on our ability to create popular characters and creative storylines or could otherwise adversely affect our operations and/or financial performance.

WWE also provided a breakdown on how McMahon was able to make secret payments without the company’s knowledge and how the company will closed those loopholes to prevent a similar situation from ever happening again.

As previously announced on June 17, 2022, a special committee of independent members of the Company’s Board of Directors (the “Special Committee”) was formed to investigate alleged misconduct by the Company’s former Chairman and Chief Executive Officer, Vincent K. McMahon, who resigned from all positions held with the Company on July 22, 2022 but remains a stockholder with a controlling interest (“Mr. McMahon”), and another executive, who is also no longer with the Company.

The findings of the investigation identified agreements executed by Mr. McMahon which were previously unknown to the Company. On July 25, 2022, the Company announced that it had determined that certain payments that Mr. McMahon agreed to make during the period from 2006 through 2022 (including amounts paid and payable in the future totaling $14.6 million), were not appropriately recorded as expenses in the Company’s Consolidated Financial Statements. The Company subsequently identified two additional payments totaling $5.0 million, unrelated to the alleged misconduct by Mr. McMahon that led to the Special Committee investigation, that Mr. McMahon made in 2007 and 2009 that were not appropriately recorded as expenses in the Company’s Consolidated Financial Statements. Together, these unrecorded expenses total $19.6 million (the “Unrecorded Expenses”). All payments underlying the Unrecorded Expenses were or will be paid by Mr. McMahon personally. The Special Committee investigation is substantially complete.

The Company evaluated the relevant guidance associated with the Unrecorded Expenses and concluded that these amounts should have been recognized by the Company as expenses in each of the periods in which they became probable and estimable in accordance with the SEC’s Staff Accounting Bulletin Topic 5T, Miscellaneous Accounting, Accounting for Expenses or Liabilities Paid by Principal Stockholders (“Topic 5T”).

Disclosure Controls and Procedures

Our management, with the participation of our co-Chief Executive Officers and our Chief Financial and Administrative Officer, have evaluated the effectiveness of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934. As a result of the material weaknesses in our internal control over financial reporting described below, our co-Chief Executive Officers and our Chief Financial and Administrative Officer have concluded the Company’s disclosure controls and procedures were not effective as of June 30, 2022 due to the material weaknesses in the Company’s internal control over financial reporting described below.

Notwithstanding the ineffective disclosure controls and procedures as a result of the identified material weaknesses, our co-Chief Executive Officers and our Chief Financial and Administrative Officer have concluded that the consolidated financial statements as issued in this Quarterly Report on Form 10-Q present fairly, in all material respects, the Company’s financial position, results of operations and cash flows in accordance with generally accepted accounting principles in the United States of America (U.S. GAAP).

Management’s Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f). The Company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements.

Internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements prepared for external purposes in accordance with generally accepted accounting principles. Because of its inherent limitations, internal control over financial reporting may not prevent or detect all misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Under the supervision and with the participation of our management, including our co-Chief Executive Officers and our Chief Financial and Administrative Officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting as of June 30, 2022 based on the criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (the “COSO framework”).

As discussed above, based upon the evaluation of these criteria and considering the material weaknesses described below, management, with the participation of our co-Chief Executive Officers and our Chief Financial and Administrative Officer, concluded that the Company’s internal control over financial reporting was not effective as of June 30, 2022.

The material weaknesses contributed to the errors in the consolidated financial statements as originally filed for the annual periods ended December 31, 2021, 2020 and 2019, as well as the quarterly periods ended March 31, 2022 and 2021. We have concluded such errors are not material to those previously issued consolidated financial statements. The errors resulted from the Company’s untimely identification, evaluation and recognition of the Unrecorded Expenses. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

Based on our evaluation, we have concluded that we have material weaknesses in each of the following areas:

Control Environment

We did not maintain an effective control environment based on the criteria established in the COSO framework which resulted in deficiencies in principles associated with the control environment. Specifically, these control deficiencies constitute material weaknesses, either individually or in the aggregate, relating to: (i) our commitment to integrity and ethical values; and (ii) establishing structures, reporting lines, and appropriate authorities and responsibilities.

We did not maintain an effective control environment to enable the identification and mitigation of risks of accounting errors. The following were contributing factors to the material weaknesses in the control environment:

The tone from executive management was insufficient to create the proper environment for effective internal control over financial reporting and to ensure that: (i) the expectations of the board of directors concerning the importance of integrity and ethical values was demonstrated by current and former executive management; (ii) there was accountability for the performance of internal control over financial reporting responsibilities; and (iii) personnel with key positions had the appropriate training to carry out their responsibilities.

Our processes and procedures that guide accountable individuals in applying internal control over financial reporting were not adequate in preventing or detecting omissions in contractual arrangements and agreements that require accounting evaluation.

The control environment material weaknesses contributed to other material weaknesses within our system of internal controls over financial reporting in the following COSO components.

Risk Assessment

We did not maintain effective risk assessment based on the criteria established in the COSO framework which resulted in deficiencies in principles associated with risk assessment. Specifically, these control deficiencies constitute material weaknesses, either individually or in the aggregate, relating to: identifying and analyzing risks to the achievement of objectives across the entity.

Control Activities

We did not maintain effective control activities based on the criteria established in the COSO framework which resulted in deficiencies in the principles associated with the control activities. Specifically, these control deficiencies constitute material weaknesses, either individually or in the aggregate, relating to: selecting and developing control activities that contribute to the mitigation of risks and support achievement of objectives.

The following were contributing factors to the material weaknesses in control activities:

We did not adequately consider the specific characteristics of our organization that could impact our accounting for certain transactions, such as a controlling stockholder in the positions of Chairman of the Board and Chief Executive Officer, when selecting and developing control activities to respond to risks.

We did not have robust control activities to identify and report agreements to the accounting team for evaluation of accounting and reporting requirements.

Monitoring

We did not maintain effective monitoring activities based on the criteria established in the COSO framework which resulted in deficiencies in the principles associated with the monitoring component. Specifically, these control deficiencies constitute material weaknesses, either individually or in the aggregate, relating to: developing and performing an ongoing evaluation to ascertain whether the components of internal controls are present and functioning.

The following was a contributing factor to the material weaknesses in monitoring activities:

Management did not build ongoing evaluations into the business processes and adjust for changing conditions.

Remediation Plan and Status

As of June 30, 2022, the material weaknesses described above have not yet been fully remediated.

Our management is committed to remediating identified control deficiencies (including both those that rise to the level of a material weakness and those that do not), fostering continuous improvement in our internal controls and enhancing our overall internal controls environment. Our management believes that these remediation actions, along with additional actions, when fully implemented, will remediate the material weaknesses we have identified and strengthen our internal control over financial reporting. Our remediation efforts are ongoing and additional remediation initiatives may be necessary.

The following remediation activities highlight our commitment to remediating our identified material weaknesses

Control Environment

We have undertaken steps to address material weaknesses in the control environment. The control environment, which is the responsibility of management, sets the tone of the organization, influences the control consciousness of its people, and is the foundation for all other components of internal control over financial reporting. Our Audit Committee and executive management team have emphasized and continue to emphasize the importance of internal control over financial reporting, as well as the integrity of our financial statements.

Our management has taken and will continue to take steps to ensure that identified control deficiencies will be remediated through the implementation of internal control policies and procedures with proper oversight. We have implemented certain changes and plan to implement additional changes including:

The Company has initiated certain personnel changes, including the promotion of new co-CEOs who have the appropriate experience and commitment to integrity and ethical values, to improve the tone at the top, communication and compliance within the Company.

The Company’s management will provide training to employees with internal control responsibilities, particularly the new co-CEOs, to ensure adequate knowledge of, and adherence to, our processes supporting internal controls over financial reporting, including increased education regarding the Company’s disclosure and other regulatory requirements.

The Company’s management will further promote and communicate the importance of its core values, including our commitment to integrity and ethical values, through Company-wide, consistent in employee and leadership meetings and on the Company’s intranet site.

The Special Committee of the Board of Directors has engaged a third-party consultant with expertise in culture assessment and change to partner with management to conducting a comprehensive culture review and recommending human capital initiatives and best practices.

The Company will distribute an updated employee handbook and implement an annual Company-wide Code of Conduct training to ensure that all employees, particularly those with internal control responsibilities, understand the Company’s standards, rules and expectations to ensure compliance, the importance of communicating matters to accounting, and the availability and use of the Company’s whistleblower program.

Reconsider delegation of authority by the Board of Directors and revise certain legal and other processes, including code of conduct and contract management.

Risk Assessment

We plan to review our existing overall Company-wide risk assessment process to ensure that it is robust and frequent enough for the Company’s dynamic business and closely-held publicly traded organization, including the identification of risks, the level of detail in our risk assessment, and the clarity of the linkage between risks and internal controls associated with the material weaknesses. The results of this effort are expected to enable us to effectively identify, develop, evolve and implement controls and procedures to address risks.

Control Activities

Our management has taken and will continue to take steps to ensure that identified control deficiencies will be remediated through the implementation of internal control policies and procedures with proper oversight. We are in the process of strengthening our control activities, including:

The Company’s management is designing control activities to enhance the process for the identification and reporting of agreements to the accounting department. In particular, the quarterly certification statements reviewed and attested to by senior executives will include appropriate representation that all agreements have been properly reported to the accounting department.

The Company’s management will provide education and reinforce requirements to executives with responsibilities for internal controls, including increased education regarding the Company’s disclosure and other regulatory requirements.

Monitoring

Our management has taken and will continue to take steps to ensure that identified control deficiencies will be remediated through the implementation of internal control policies and procedures with proper oversight. We are in the process of strengthening our monitoring, including:

In connection with the review our existing overall Company-wide risk assessment process, we plan to revisit our entity-level controls to ensure that they adequately address focal points of the COSO framework as they relate to our business and organization.

Management will develop a monitoring program to periodically evaluate and assess whether those responsible for controls are conducting their activities in accordance with their design, such that there is contemporaneous evidence that the controls are present and functioning.

Remediation of the identified material weaknesses and strengthening our internal control environment will require a substantial effort. We will test the ongoing operating effectiveness of the new and existing controls in future periods. The material weaknesses cannot be considered completely remediated until the applicable controls have operated for a sufficient period of time and management has concluded, through testing, that these controls are operating effectively.

While we believe the steps planned will remediate the effectiveness of our internal control over financial reporting, we have not completed all remediation efforts identified herein. Accordingly, as we continue to monitor the effectiveness of our internal control over financial reporting in the areas affected by the material weaknesses described above, we have and will continue to perform additional procedures prescribed by management, including the use of manual mitigating control procedures and employing any additional tools and resources deemed necessary, to ensure that our consolidated financial statements are fairly stated in all material respects.

Changes in Internal Control over Financial Reporting

The material weaknesses identified above were discovered after June 30, 2022, and all of these material weaknesses existed as of June 30, 2022. The remediation activities identified above and any material changes to our internal control over financial reporting also occurred after June 30, 2022. Therefore, there were no changes in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the quarter ended June 30, 2022 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

AEW: Shane Taylor vs. HOOK for FTW Title Announced for Battle of the Belts X, New Matches Announced for 4/13th Collision & 4/17 Dynamite Shows, Dustin Rhodes

AEW: Shane Taylor vs. HOOK for FTW Title Announced for Battle of the Belts X, New Matches Announced for 4/13th Collision & 4/17 Dynamite Shows, Dustin Rhodes Various: Hammerstone on His TNA Signing, Sabu on Reason for No Showing GCW’s Indie Hall of Fame Event, Dark Side of the Ring Ratings

Various: Hammerstone on His TNA Signing, Sabu on Reason for No Showing GCW’s Indie Hall of Fame Event, Dark Side of the Ring Ratings Various: Jon Moxley on Getting IWGP World Title Opportunity in NJPW, TNA Announces June Date for Against All Odds 2024 in Chicago, Indies

Various: Jon Moxley on Getting IWGP World Title Opportunity in NJPW, TNA Announces June Date for Against All Odds 2024 in Chicago, Indies